Inventory transfer: LME’s “short trap” and COMEX’s “premium bubble” LME copper stocks have plummeted to 138,000 tons, halving from the beginning of the year. On the surface, this is ironclad evidence of tight supply. But behind the data, a transatlantic “inventory migration” is taking place: COMEX copper stocks have soared by 90% in two months, while LME stocks have continued to flow out. This anomaly reveals a key fact – the market is artificially creating regional shortages. Traders transferred copper from LME warehouses to the United States because of the Trump administration’s tough stance on metal tariffs. The current premium of COMEX copper futures to LME copper is as high as $1,321 per ton. This extreme price difference is essentially the product of “tariff arbitrage”: speculators bet that the United States may impose tariffs on copper imports in the future, and ship metal to the United States in advance to lock in the premium. This operation is exactly the same as the “Tsingshan Nickel” incident in 2021. At that time, LME nickel stocks were largely written off and shipped to Asian warehouses, directly triggering an epic short squeeze. Today, the proportion of LME cancelled warehouse receipts is still as high as 43%, which means that more copper is being delivered out of the warehouse. Once this copper flows into the COMEX warehouse, the so-called “supply shortage” will collapse instantly.

Policy panic: How does Trump’s “tariff stick” distort the market?

Trump’s move to raise aluminum and steel tariffs to 50% has become the fuse that ignited the panic in copper prices. Although copper has not yet been included in the tariff list, the market has begun to “rehearse” the worst-case scenario. This panic buying behavior has made the policy a self-fulfilling prophecy. The deeper contradiction is that the United States simply cannot afford the cost of interrupting copper imports. As one of the world’s largest copper consumers, the United States needs to import 3 million tons of refined copper each year, while its domestic production is only 1 million tons. If tariffs are imposed on copper, downstream industries such as automobiles and electricity will ultimately pay the bill. This “shooting oneself in the foot” policy is essentially just a bargaining chip for political games, but it is interpreted by the market as a substantial negative.

Supply disruption: Is the production suspension in the Democratic Republic of Congo a “black swan” or a “paper tiger”?

The brief suspension of production at the Kakula copper mine in the Democratic Republic of the Congo has been exaggerated by bulls as an example of a supply crisis. However, it should be noted that the mine’s output in 2023 will only account for 0.6% of the world’s total, and Ivanhoe Mines has announced that it will resume production this month. Compared with sudden events, what is more worthy of vigilance is the long-term supply bottleneck: the global copper grade continues to decline, and the development cycle of new projects is as long as 7-10 years. This is the medium- and long-term logic supporting copper prices. However, the current market has fallen into a mismatch between “short-term speculation” and “long-term value”. Speculative funds use any supply-side disturbances to create panic, but ignore a key variable-China’s hidden inventory. According to CRU estimates, China’s bonded area and informal channel inventories may exceed 1 million tons, and this part of the “undercurrent” may become a “safety valve” to stabilize prices at any time.

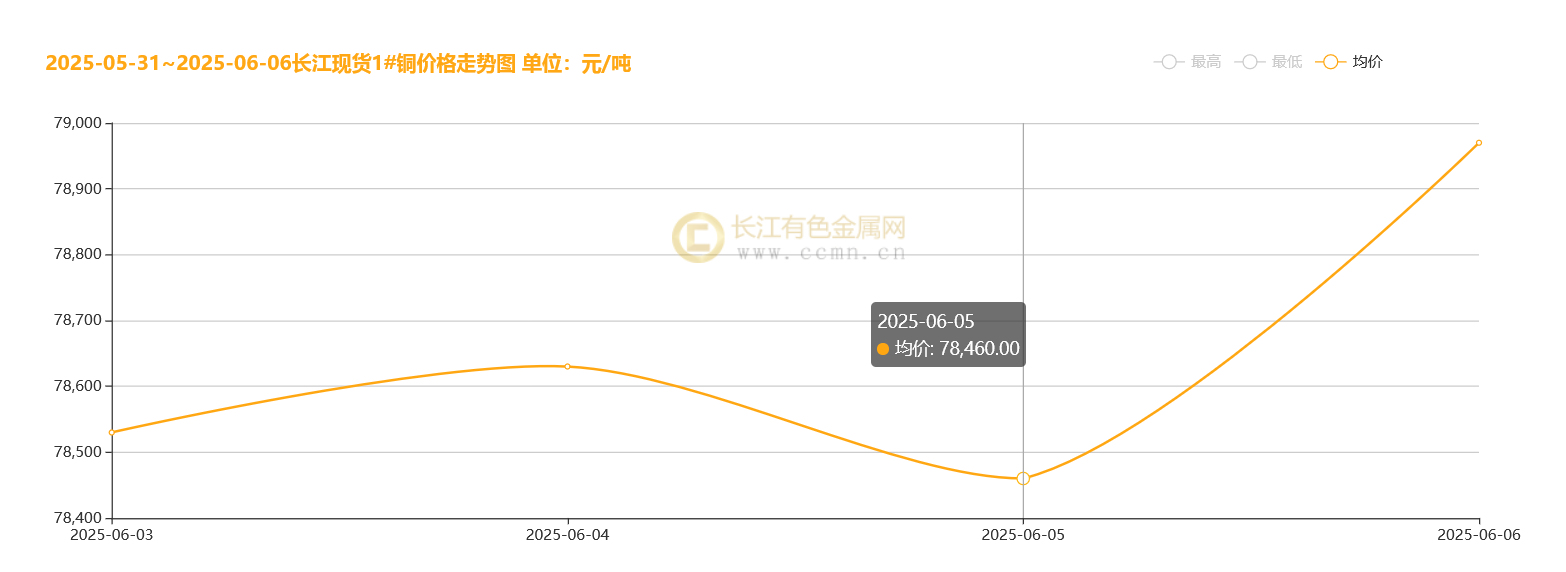

Copper prices: walking a tightrope between short squeeze and collapse

Technically, after copper prices broke through key resistance levels, trend investors such as CTA funds accelerated their entry, forming a positive feedback loop of “rise-short stop-further rise”. However, this rise based on momentum trading often ends in a “V-shaped reversal”. Once tariff expectations fail or the inventory transfer game ends, copper prices may face a sharp correction. For the industry, the current high premium environment is distorting the pricing mechanism: the LME spot discount to March copper has widened, reflecting weak physical buying; while the COMEX market is dominated by speculative funds, and prices are seriously distorted. This split market structure will ultimately be paid by end consumers-all industries that rely on copper, from electric vehicles to data centers, will be under cost pressure.

Summary: Beware of the “metal carnival” without supply and demand support

Amid the cheers of copper prices breaking through the trillion-dollar mark, we need to think more calmly: when price increases are divorced from real demand and when inventory games replace industrial logic, this kind of “prosperity” is destined to be a tower built on sand. Trump’s tariff stick may be able to leverage short-term prices, but what really determines the fate of copper prices is still the pulse of the global manufacturing industry. In this game between capital and entities, it is more important to stay sober than to chase bubbles.

Post time: Jun-07-2025